NBFC Registration Procedure And License With RBI In India

Knowing a Non-banking Financial Company in Detail

An NBFC is actually a company that is registered under the 1956, Companies Act and is typically involved in the act of providing advances and loans or acquisition of stocks/bonds/shares/securities/debentures which are issued either by the Government or local authority.

Desirous of Exploring The NBFC Sace?

The rapidly-growing Indian economy has provided an excellent opportunity to Non-Banking Financial Companies (NBFCs) in creating a niche for themselves in recent years.

The NBFCs do not hold banking licenses but they offer almost every service that banks do including accepting deposits, offering loans, performing financial intermediation, offering cash advances, leasing, hire purchases, etc.

In a thickly populated country like India, mainstream banking services are not capable of fulfilling the financial needs of all the citizens. Owing to this fact, the NBFC has been able to carve a space for itself by making inroads into the country.

NBFCs have grown at a remarkable pace in the last decade as a consequence of their customer-friendly approach, great flexibility, and attractive rate of returns. They cater to the urban and the rural, the needy and the deprived, as they have penetrated small towns and villages.

Understanding What Does Conducting Financial Activity as ‘Principal Business’ Means

An organisation is said to be primarily involved in Financial Activities when its assets constitute more than fifty percent of the total assets and income from financial assets contribute to more than 50 percent of the gross income. Also, the RBI would register any such company which fulfills the above requirements as an NBFC. The RBI has not given any stipulated definition for the term ‘principal business’ but only companies involved in financial activities get registered with it and it acts as a supervisory and regulatory body.

Who Is The Regulatory Authority of NBFCs?

The working and operating of NBFCs are regulated by the Reserve Bank of India (RBI) within the framework of the Reserve Bank of India Act, 1934. From time to time the RBI issues guidelines and directions to be followed by the NBFCs.

Section 45-IA mandates that no NBFC shall begin or carry on the business of a Non-Banking Financial Institution without obtaining a Certificate of Registration (COR) from the RBI.

Know The Areas of Business of NBFCs

These will throw light on the wide scope of business opportunities of NBFCs.

- Acquisition of shares/ stocks/ securities/ bonds/ debentures issued by the Government or other authorities,

- Loans and Advances,

- Insurance Business,

- Chit Business,

- Hire-purchase,

- Leasing.

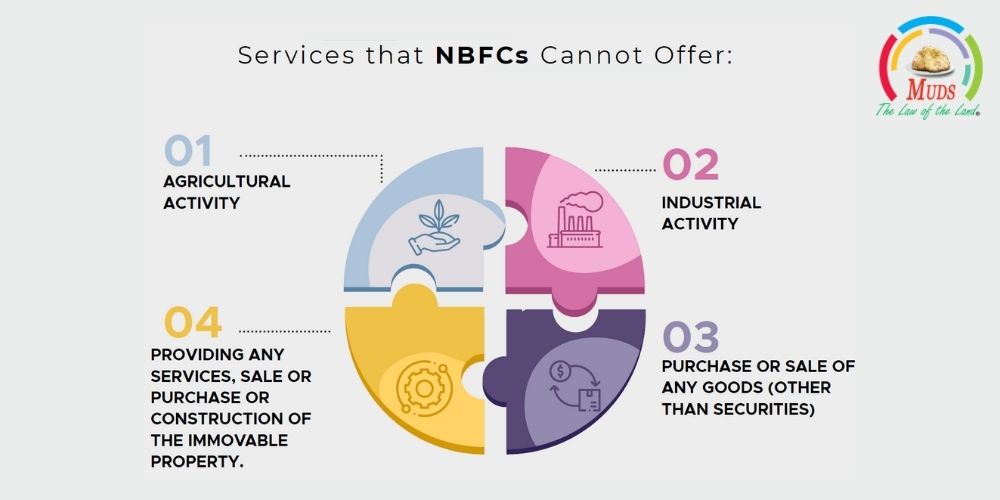

Services that NBFCs Cannot Offer:

RBI clearly defines the domains which cannot be touched by the NBFCs:

- agricultural activity,

- industrial activity,

- purchase or sale of any goods (other than securities), or

- providing any services, sale or purchase, or construction of the immovable property.

What makes an NBFC different from a Bank?

Lending money and making investments is a common thread that makes the functioning of a bank and an NBFC alike. But actually, the two are really different from each other.

#1. A bank accepts demand deposits while an NBFC cannot.

#2. Banks actually form part of the payment and settlement system and issue cheques drawn on itself whereas an NBFC simply cannot perform this task as it is outside its working domain.

#3. The banks allow deposit insurance facility of the Deposit Insurance and Credit Guarantee Corporation which is available to the depositor. But for an NBFC, this facility does not work at all.

Different Categories of NBFCs Registered With RBI

The NBFCs are categorized here based on the kind of activity they primarily undertake, knowing about them shall provide you insight as to your own preferences.

- Non-Banking Financial Company-Micro Finance Institution

- Infrastructure Debt Fund Non- Banking Financial Company

- Systemically Important Core Investment Company

- Non-Banking Financial Company-Factors

- NBFC- Non-Operative Financial Holding Company

- Mortgage Guarantee Companies

- Infrastructure Finance Company

- Asset Finance Company

- Investment Company

- Loan Company

Understanding Systematically Important NBFCs

Systematically Important NBFCs are those whose asset size if equal to or greater than 500 crores as per the latest audited balance sheet. They are classified differently as they have an impact on the financial stability of the overall economy.

Eligibility Norms For Registration of NBFCs

You should be ready with this pre-work before you seek NBFC incorporation.

- Company should be registered under the Companies Act, 2013 or Companies Act, 1956

- Company should have Minimum Net Owned Fund of INR 2 crore

(Net Owned Funds to be calculated on the basis of the last audited balance sheet of the Company)

The Procedure of Registration of NBFCs

It shall be beneficial for you to know in brief about the procedure of Registration of NBFC:

- First formality is an incorporation of the applicant company under the Companies Act, 1956 or 2013, with Minimum

- Net Owned Fund of INR 2 crore (Equity Share Capital & not Preference Share Capital).

- Thereafter the applicant company needs to open a Bank Account and keep the entire sum of INR 2 crores in the bank’s deposit account, which should be free from all liens.

- The applicant is then required to apply for registration online on RBI’s official COSMOS website.

- Post submission of the form, CARN (Company Application Reference Number) is generated that is helpful in future references.

- Subsequently, the hard copies of all the documents are required to be submitted to the concerned Regional Office of RBI.

- The Regional Office shall scrutinize the authenticity of the documents and on being satisfied, shall forward it to the Central Office.

- The Central Office of RBI grants the NBFC registration only after the fulfillment of all prescribed requirements by the company under section 45-IA, of its act of 1934.

Also Read:-

Is RBI NBFC Registration mandatory?

Yes, the given registration is a mandatory requirement for every NBFC. An NBFC cannot begin its business if the following two demands are not fulfilled:

#1. Net Owned Funds amounting to ₹25 lakhs.

#2. Registration with RBI.

On the contrary, a few categories of NBFC are exempted from this rule as they are governed by other regulatory authorities. For example, Merchant Banking Companies, Venture Capital Fund, Stock Broking Companies etc. are registered with SEBI. This process has been initiated to avoid doubling of regulations.

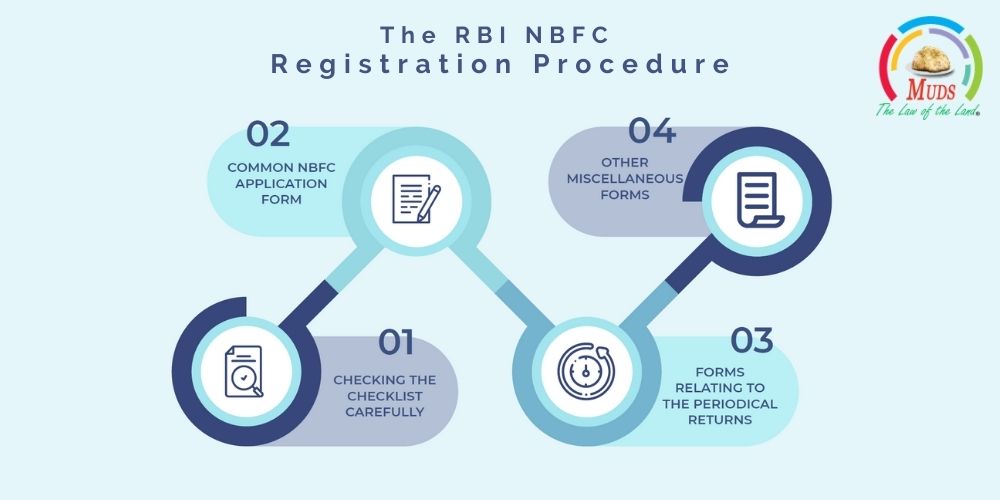

The RBI NBFC Registration Procedure

The following essential documents are to be submitted along with the application form at the Regional Office of the Reserve Bank Of India:

#1. Checking the checklist carefully

#2. Common NBFC Application Form

#3. Forms relating to the Periodical Returns

#4. Other Miscellaneous Forms

Highlighting the powers of Reserve Bank Of India in regards to NBFCs that Meet the 50-50 Criteria

The RBI Act 1937, gives rights and powers to the Reserve Bank for registering, lying down policies, issuing directions, inspecting, regulating, supervising, and exercising surveillance over the various NBFCs that actually meet the 50-50 requirements of principal business.

The NBFCs can be penalized if they violate the provisions laid by the RBI Act. This can even lead to the cancellation of Certificate of Registration that was issued to the NBFC. This would even prohibit the NBFC from accepting deposits.

Where to look out for Registered NBFCs and instructions issued to NBFC?

The list of registered NBFCs and the various notifications are available on the Reserve Bank of India website www.rbi.org.in

Responsibilities of NBFCs that are registered with Reserve Bank of India regarding the submission, compliances, and other information

The deposit-taking NBFCs have to submit the following returns:

- NBS-1 Quarterly Returns on deposits in First Schedule.

- NBS-2 Quarterly return on Prudential Norms is required to be submitted by NBFC accepting public deposits.

- NBS-3 Quarterly return on Liquid Assets by deposit taking NBFC.

- NBS-4 Annual return of critical parameters by a rejected company holding public deposits. (NBS-5 stands withdrawn as submission of NBS 1 has been made quarterly.)

- NBS-6 Monthly return on exposure to capital market by deposit taking NBFC with total assets of ₹ 100 crore and above.

- Half-yearly ALM return by NBFC holding public deposits of more than ₹ 20 crores or asset size of more than ₹ 100 crore

- Audited Balance sheet and Auditor’s Report by NBFC accepting public deposits.

- Branch Info Return.

Various Returns Submitted by NBFCs

- NBS-7 A Quarterly statement of capital funds, risk weighted assets, risk asset ratio etc., for NBFC-ND-SI.

- Monthly Return on Important Financial Parameters of NBFCs-ND-SI.

- ALM returns:

(i) Statement of short term dynamic liquidity in format ALM [NBS-ALM1] -Monthly,

(ii) Statement of structural liquidity in format ALM [NBS-ALM2] Half yearly,

(iii) Statement of Interest Rate Sensitivity in format ALM -[NBS-ALM3], Half yearly

Keep These Documents Ready Before Applying for NBFC Registration

Along with the application, there is a long list of documents to be submitted:

- Certificate of Incorporation (Certified Copy Issued by ROC)

- Extract of Main Object Clause in MOA (Clearly depicting Financial Business)

- Board of Resolution stating the following before getting registration from RBI:

- Adherence to the “Fair Practices Code (as per RBI guidelines)

- Non-carrying out any NBFC activity

- Non-carrying out of acceptance of any public deposit

- Audited Balance Sheet & Profit & Loss account along with directors and auditor’s report (for the entire period of the company’s existence or last 3 years, whichever is less)

- Director’s Highest Educational & Professional Qualification (Copy of certificate)

- Director’s experience in the Financial Services Sector, including the Banking Sector (Copy of certificate)

- Details of deposits & loans balances as on the date of application & conduct of account (Bankers report)

The Most Opportune Time For NBFCs

This can be called the most lucrative period to venture into NBFC business as the economy is thriving. The banks still have a lot of ground to cover and the vacuum left by them is being tapped by NBFCs in various segments. The earlier you enter this space, the more customers you will be able to capture, carving a bright future for your company.

Significant Factors Working In Favour of NBFCs

- Simplification of norms means attracting more customers is easier for NBFCs.

- The freedom to structure the products as per the needs of the customer gives it an edge over others.

- NBFCs have a definite advantage over banks as they can capture customers from the remotest of places.

- The operational costs are lower which result in higher earnings for such companies.

Contact MUDS At The Earliest For A Bright Future!

MUDS consultancy firm has an efficient team of professionals who are adept in extending swift services like NBFC registration.

Their impeccable track record speaks for their efficiency and capabilities.

They will ensure attainment of COR in the shortest time period and without any botheration to you.

“The future of NBFCs in India is secure for many years to come, therefore, the sooner you capture this space, the better it would be!”

-Shweta Gupta, Founder, and CEO, MUDS