Types of Preference Shares

Preference shares is the term given to the shares of priority compared to the equity shares. These shares are bound with preferential right to get the dividends declared by the company on priority basis. While the dividend declaration, the preference shareholders are entitled to receive the dividend before the equity shareholders. These shareholders not only have a preferential right on dividends but also a right on the proceeds that are realized from the sale of the company’s assets in case of liquidation of the company. This will be done while the payments are released to the creditors of the company.

As per explanation given in the Section 42 of the Companies Act, 2013, the term preference shares includes the part of share capital to which the holders have a preferential right during payment of dividend and repayment of share capital in the event of company liquidation.

Preference shares also pay a higher rate of dividend compared to normal equity shares. However, this is given at a fixed rate or as a fixed amount. The preference shareholders are given somewhat privileged treatment by the company.

It must be noted that a company can issue preference shares only if these shares are a part of the authorized share capital of as per the MoA (Memorandum of Association) submitted to the RoC. It is important to verify through the AoA (Articles of Association) that it grants authorization to issue preference shares. In the scenario where the MoA or the AoA of the company do not state the right to issue preference shares, necessary amendments must be made in these documents before issuing such shares to avoid any legal glitch.

We have mentioned previously, Preference shares often pay dividends at a relatively higher rate as against other categories of shares. Preference shareholders are also given the privilege to get a share in the surplus profits of the company which are leftover post payment of dividend to all the equity shareholders.

Indian companies generally issue two types of shares while going public. The first one are ordinary or equity shares and the other ones are the preference shares. Let us now understand the basic difference between both of these types before moving on to understand preference shares in detail.

The following table explains the two types of shares and the different rights attached to them.

Ordinary shares Vs Preference shares – a comparison

| Characteristics | Ordinary Shares | Preference Shares |

|---|---|---|

| General Character | These are equity investment and are among the common types of shares. | Preference shares have the characteristics of both equity and debt instruments. These shares don’t grant its holder right to vote. |

| For Whom? | These are suitable for individuals who are looking for: Control(voting rights); participation in profits (dividend income)and growth (capital appreciation of share price) | Preference shares are for those individuals who do not require voting rights and involvements in the operations of the company thereby opting for medium risks and returns. |

| Right to vote | The holders of these shares have full voting rights. Ordinary shareholders are regarded as the owners of the company and have full autonomy in the decision making process. | Holders of preference shares have limited voting rights. They have the autonomy to vote on matters that significantly affect their interest. |

| Dividend Payment | Payment of dividend is made after paying a dividend to preference shareholders. | Preference shareholders holders receive dividends prior to ordinary shareholders |

| Dividend rate | Payment of dividend to ordinary shareholders is neither mandatory nor fixed. The rate of dividend depends on the discretion of the board of directors | Preference shareholders generally have a right to receive a dividend at a fixed rate. |

| Dividend Accumulation | The holders of these shares do not have any rights on accumulated dividends from previous years. | Preference shares may have a cumulative right to receive accumulated dividends from previous years. |

| Redemption of shares | These shares cannot be redeemed by the company. | Redeemable preference shares can be redeemed in the future by the company. |

| Option of convertibility | These shares are not convertible to any other class of shares. | Convertible preference shares have the option to convert ordinary shares at a pre-determined rate and time. |

| Capital repayment post winding up of the company | Ordinary shareholders receive their share in the proceeds realized after payment of various winding costs and payment to preference shareholders. | Preference shareholders receive repayment of leftover capital from creditors but before ordinary shareholders. |

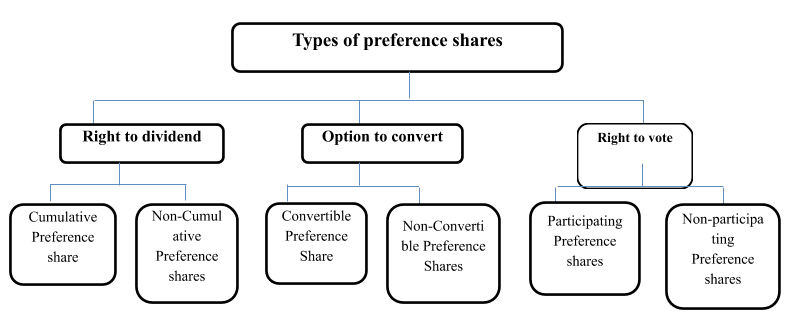

Types of Preference Shares

Generally, the difference in types of preference shares crop up due to the various rights attached to them. The differences may be on account of the right to receive dividends of the company or relating to voting rights in relation to business and management or the right to hold such shares. On this note the types of preferences shares are as follows:

Right to Dividend

Cumulative and Non-Cumulative Preference Shares

Based upon the right on the dividend paid by the company, preference shares may be cumulative or non-cumulative. There may or may not an obligation on the company to pay dividends, irrespective of profits in any year.

In the case of cumulative preference shares, the dividends keep on accumulating over a period of time leading to an obligation on the business to pay it out of profit in later years only to preference shareholders. Any unpaid dividends on cumulative preference shares keep on accumulating. It is important to note that the company needs to make provision for paying back arrears dividends before paying to ordinary equity shareholders. In general preference shares are cumulative except explicitly specified as non-cumulative.

On the other hand, in case you of non-cumulative preference share, shareholders are treated on the same footing as ordinary shareholders. The only noteworthy point is that the company needs to declare a dividend in case of profit in a particular year. However, the difference is that the holders of such shares get the dividend prior to the ordinary shareholders and at a pre-decided fixed rate.

Option to Convert Into Ordinary Shares

Convertible and Non-convertible Preference Shares

There may be an option attached to preference shares wherein the holder of such shares can convert the held units of preference shares into ordinary shares after a specific period of time.it is important to note that the aforesaid option can be exercised at the time of filling the application for purchasing preference shares.

The preference shares which entitle its holders to convert such shares into equity shares after a certain span of time are known as convertible preference shares. In this case, the holder becomes entitled to convert such shares to ordinary shares on a pre-specified date and price. The other name of this category is redeemable preference shares. These preference shares are redeemed or repaid after the expiry of a fixed period or as per the prescribed notice issued by the company.

On the other hand, the reverse of the aforesaid right is non-convertible preference shares or non-redeemable preference shares. The holders of non-convertible preference shares are not bound to get their holdings converted into equity shares. The company while issuing non-convertible preference shares may grant the option to the holders of such shares to resell such non-convertible preference shares in a stock market.

Right to Vote

Participating and Non-Participating Preference Shares

Ordinary shareholders have the right to vote in the workings of the business. Companies, in order to take any crucial decisions, require approval from common shareholders. It is important to note that preference shareholders have no voice in the decision-making process. In some scenarios that majorly affect their interest, the preference shareholders have voting rights with limited scope.

The holders of participating preference shares are eligible to participate in the balance profits in line with the ordinary shareholders. Same as other preference shareholders the participating preference shareholders are also entitled to receive a fixed rate of dividend on shareholdings. Apart from the right to receive dividends, the participating preference shareholders have a share in any surplus assets in case of winding up of the company.

The non-participating preference shareholders receive only a fixed rate of dividend. They do not share the surplus profits. Mostly the preference shares are non-participating by their very nature until expressly mentioned in the memorandum or articles regarding the issue of preference shares.

Also Read:-

Types of Preference Shares to Meet Specific Needs

Seeking Regular Income

If you are targeting regular income then cumulative preference shares are the best option. The reason being the holders of such shares get regular fixed dividend on the investment made in such shares. Even when the company does not make a profit, the cumulative preference shareholder shall be eligible to receive the dividend in subsequent years in priority to other shareholders.

In the scenario where you are only targeting preference in dividend payment over common shareholders, then one can go with non-cumulative preference shares.

Share in the Company

If you are seeking to own share in the company after tracking the performance of the company then you may opt for redeemable preference shares.

On the other hand, if you are looking for a regular fixed income higher than the fixed income instruments then you can opt for non-redeemable preference shares

Participation in Decision Making

If you are willing to participate in the decision-making process then in such a scenario participating preference shares are the best option to fulfill this need.

Hope this article was interesting and informative in highlighting the points of difference between ordinary shares and preference shares. The bifurcations and different types of preference shares along with specific types to suit needs have also been discussed in this article.